Can I Claim A Laptop As A Business Expense Uk . find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. You use the equipment for work and there’s no. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. how can i reduce my income tax by claiming business expenses? you can only claim tax relief for equipment expenses if: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. As a sole trader or freelancer, all your income. you can claim expenses for: Phone, mobile, fax and internet bills. You need it to do your job.

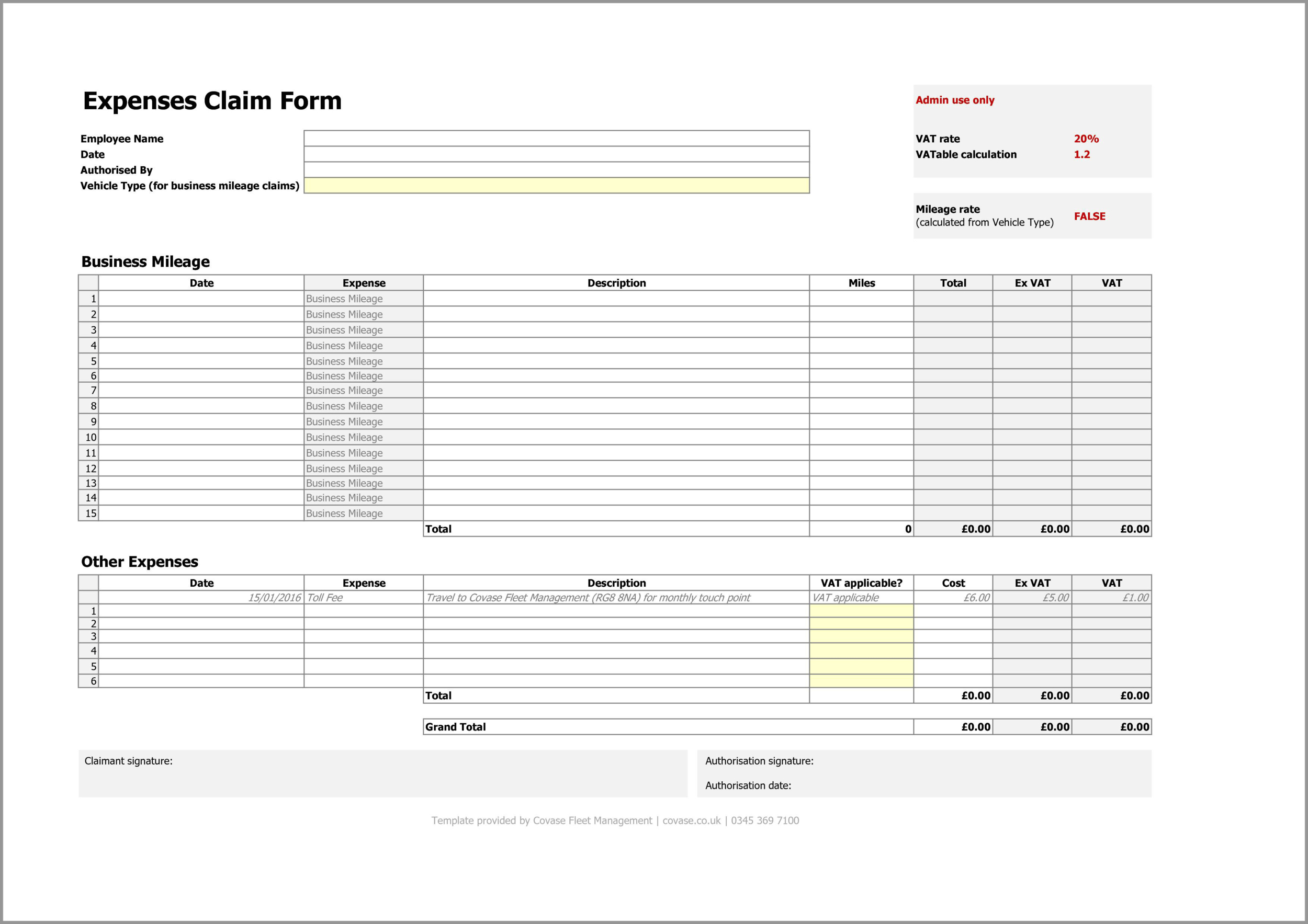

from www.covase.co.uk

you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. As a sole trader or freelancer, all your income. find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. you can claim expenses for: You need it to do your job. Phone, mobile, fax and internet bills. You use the equipment for work and there’s no. you can only claim tax relief for equipment expenses if: how can i reduce my income tax by claiming business expenses? claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your.

Expenses Form UK Free Excel Template Download — Covase Fleet

Can I Claim A Laptop As A Business Expense Uk Phone, mobile, fax and internet bills. Phone, mobile, fax and internet bills. find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. As a sole trader or freelancer, all your income. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. how can i reduce my income tax by claiming business expenses? You use the equipment for work and there’s no. claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. you can only claim tax relief for equipment expenses if: you can claim expenses for: You need it to do your job.

From www.xltemplates.org

Expense Claim Form Template for EXCEL Excel Templates Can I Claim A Laptop As A Business Expense Uk You need it to do your job. You use the equipment for work and there’s no. As a sole trader or freelancer, all your income. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. you can claim expenses for: you can only claim. Can I Claim A Laptop As A Business Expense Uk.

From www.eclataccountancy.co.uk

How To Claim A Laptop As A Business Expense Eclat Accountancy Can I Claim A Laptop As A Business Expense Uk You use the equipment for work and there’s no. Phone, mobile, fax and internet bills. find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. As a sole trader or freelancer, all your income. You need it to do your job. you can claim expenses for:. Can I Claim A Laptop As A Business Expense Uk.

From db-excel.com

Business Expenses Claim Form Template — Can I Claim A Laptop As A Business Expense Uk You need it to do your job. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. Phone, mobile, fax and internet bills. As a sole trader or freelancer, all your income. you can only claim tax relief for equipment expenses if: find out. Can I Claim A Laptop As A Business Expense Uk.

From mavink.com

Expense Claim Sheet Can I Claim A Laptop As A Business Expense Uk you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. you can claim expenses for: you can only claim tax relief for equipment expenses if: Phone, mobile, fax and internet bills. You use the equipment for work and there’s no. how can i. Can I Claim A Laptop As A Business Expense Uk.

From www.getexceltemplates.com

7+ Expense Claim Form Templates Excel Templates Can I Claim A Laptop As A Business Expense Uk Phone, mobile, fax and internet bills. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. As a sole trader or freelancer, all your income. you can claim expenses for: you can only claim tax relief for equipment expenses if: You use the equipment. Can I Claim A Laptop As A Business Expense Uk.

From quickbooks.intuit.com

Selfemployed business expenses all you need to know QuickBooks UK Blog Can I Claim A Laptop As A Business Expense Uk you can claim expenses for: how can i reduce my income tax by claiming business expenses? you can only claim tax relief for equipment expenses if: As a sole trader or freelancer, all your income. You use the equipment for work and there’s no. You need it to do your job. you can claim expenses for. Can I Claim A Laptop As A Business Expense Uk.

From goselfemployed.co

How to Claim Your Laptop as a Business Expense Can I Claim A Laptop As A Business Expense Uk how can i reduce my income tax by claiming business expenses? As a sole trader or freelancer, all your income. you can only claim tax relief for equipment expenses if: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. You need it to do your job. . Can I Claim A Laptop As A Business Expense Uk.

From www.goforma.com

Can I Claim the Laptop as an Allowable Expense? Can I Claim A Laptop As A Business Expense Uk As a sole trader or freelancer, all your income. you can claim expenses for: You use the equipment for work and there’s no. You need it to do your job. claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. how can i reduce my income tax by. Can I Claim A Laptop As A Business Expense Uk.

From www.covase.co.uk

Expenses Form UK Free Excel Template Download — Covase Fleet Can I Claim A Laptop As A Business Expense Uk As a sole trader or freelancer, all your income. you can claim expenses for: find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. how can i reduce my income tax by claiming business expenses? you can only claim tax relief for equipment expenses. Can I Claim A Laptop As A Business Expense Uk.

From data1.skinnyms.com

Expense Claim Form Template Excel Can I Claim A Laptop As A Business Expense Uk you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. you can only claim tax relief for equipment expenses if: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. You need it to do. Can I Claim A Laptop As A Business Expense Uk.

From www.annetteandco.co.uk

Can I claim physio as a business expense? Is it tax deductible? Can I Claim A Laptop As A Business Expense Uk you can claim expenses for: find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. you can only claim tax relief. Can I Claim A Laptop As A Business Expense Uk.

From www.pinterest.com

a blue poster with the words common deductible business expenies on it Can I Claim A Laptop As A Business Expense Uk As a sole trader or freelancer, all your income. You use the equipment for work and there’s no. you can claim expenses for: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. find out how to claim the cost of a new laptop as a business expense. Can I Claim A Laptop As A Business Expense Uk.

From template.wps.com

EXCEL of Expense Claim Form.xlsx WPS Free Templates Can I Claim A Laptop As A Business Expense Uk how can i reduce my income tax by claiming business expenses? You use the equipment for work and there’s no. claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. you can claim expenses for: Phone, mobile, fax and internet bills. you can claim expenses for business. Can I Claim A Laptop As A Business Expense Uk.

From rechargevodafone.co.uk

🔴 Can I Claim A Laptop As A Business Expense Uk 2024 Updated Can I Claim A Laptop As A Business Expense Uk Phone, mobile, fax and internet bills. you can claim expenses for: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. You use the equipment for work and there’s no. you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business. Can I Claim A Laptop As A Business Expense Uk.

From fabalabse.com

Can I claim my laptop as an education expense? Leia aqui Is a laptop Can I Claim A Laptop As A Business Expense Uk you can claim expenses for business equipment such as laptops, pcs, printers, and computer software that your business has used for less than. you can claim expenses for: You use the equipment for work and there’s no. how can i reduce my income tax by claiming business expenses? Phone, mobile, fax and internet bills. find out. Can I Claim A Laptop As A Business Expense Uk.

From www.generalblue.com

Expense Claim Form in Word (Simple) Can I Claim A Laptop As A Business Expense Uk you can claim expenses for: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. Phone, mobile, fax and internet bills. find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. you can only claim. Can I Claim A Laptop As A Business Expense Uk.

From www.freeagent.com

Working from home? Learn what expenses you can claim if you use it for Can I Claim A Laptop As A Business Expense Uk As a sole trader or freelancer, all your income. you can only claim tax relief for equipment expenses if: claiming a laptop as a business expense is straightforward for sole traders, especially if you choose to keep your. You use the equipment for work and there’s no. Phone, mobile, fax and internet bills. how can i reduce. Can I Claim A Laptop As A Business Expense Uk.

From dl-uk.apowersoft.com

Expense Claim Form Template Excel Can I Claim A Laptop As A Business Expense Uk how can i reduce my income tax by claiming business expenses? you can only claim tax relief for equipment expenses if: you can claim expenses for: You need it to do your job. find out how to claim the cost of a new laptop as a business expense and other computer equipment as a tax. . Can I Claim A Laptop As A Business Expense Uk.